You Can’t Underwrite What You Can’t See

Spreadsheets don’t show it. Lease abstracts won’t flag it.

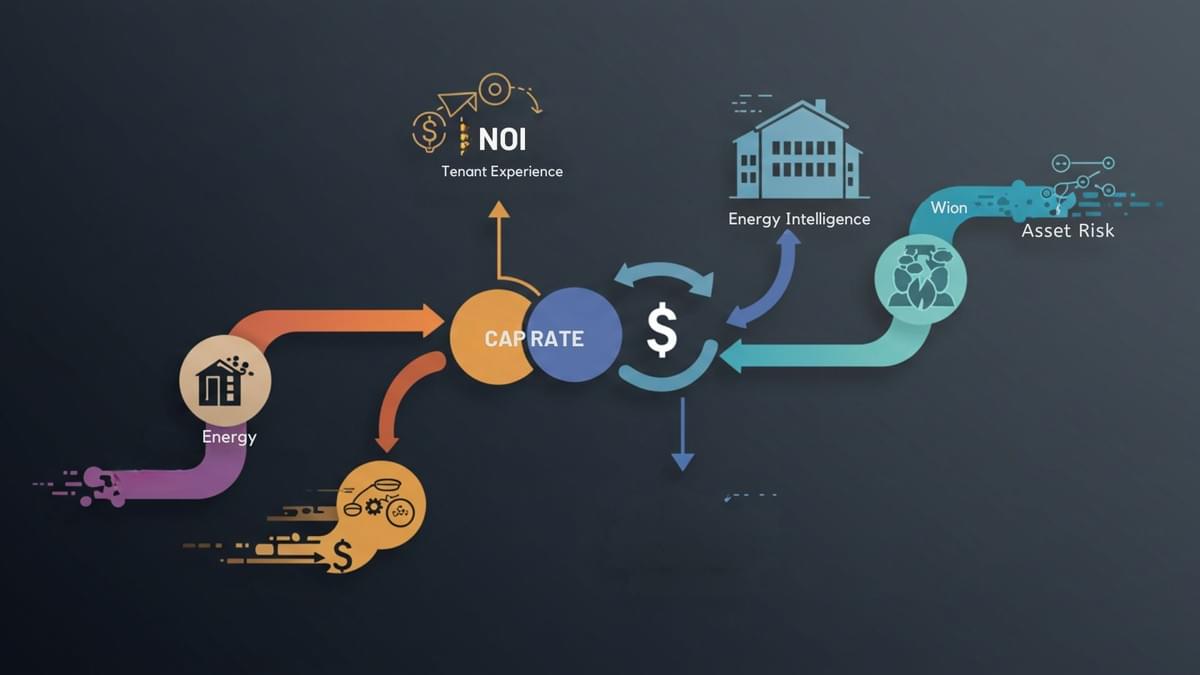

But buried beneath every building’s surface is a hidden lever that directly impacts cap rate: infrastructure intelligence.

“Valuation gains increasingly come from operational leverage—not just rent.”

— Peak Property Performance

The Investor Blind Spot: Outdated Infrastructure Erodes Cap Rates

Let’s look at the data:

- A McKinsey-led digital twin case study showed 45–70% cost reduction potential when infrastructure systems are integrated and automated. (mckinsey.com)

- ENERGY STAR buildings show higher NOI, faster lease-ups, and lower risk profiles.

- At “The Edge” in Amsterdam, smart building systems led to 70% energy reduction and asset premium valuation. (green.org)

Real-Life: The Acquisition With a Digital Twist

An investor client was eyeing a 14-building acquisition—great location, stabilized leases, solid tenant base. But a due diligence run with OpticWise revealed:

- Fragmented vendor stack

- No building-wide network

- Cyber risk from unsecured IoT points

Cap rate was re-evaluated post digital retrofit plan. Result? NOI projected up 11%, cap rate tightened, and valuation jumped $5.7M.

Why Infrastructure Is the Next Net-New Asset Class

If you're not evaluating:

- Energy analytics

- Embedded Wi-Fi

- Unified access control

- Predictive maintenance alerts

… then you’re not valuing the asset fully.

Investor Action Plan

- Integrate a Digital Infrastructure Layer into your underwriting checklist

- Ask: Can tenants connect and operate Day 1?

- Assess: Are ops teams flying blind or empowered?