Underwriting Has Evolved—Have You?

In the past, real estate underwriting looked at three core levers: location, lease rates, and occupancy. But in 2025, there's a fourth lever every sophisticated investor must evaluate: digital infrastructure readiness.

It’s no longer a bonus. It’s a valuation differentiator.

“Modern infrastructure is the invisible layer that separates a 6-cap from a 5-cap asset.”

— Peak Property Performance

Why Digital Infrastructure Now Impacts Cap Rate

Here’s why digital infrastructure is being weighted more heavily in investment decisions:

- Tenant retention is now tied to tech experience

- OPEX management depends on system visibility and automation

- Cyber risk is now a factor in lender risk assessment

- ESG disclosures require building-level performance data

Stat: Over 74% of institutional investors now include infrastructure-readiness in diligence reports. (CBRE Digital Strategy Report, 2024)

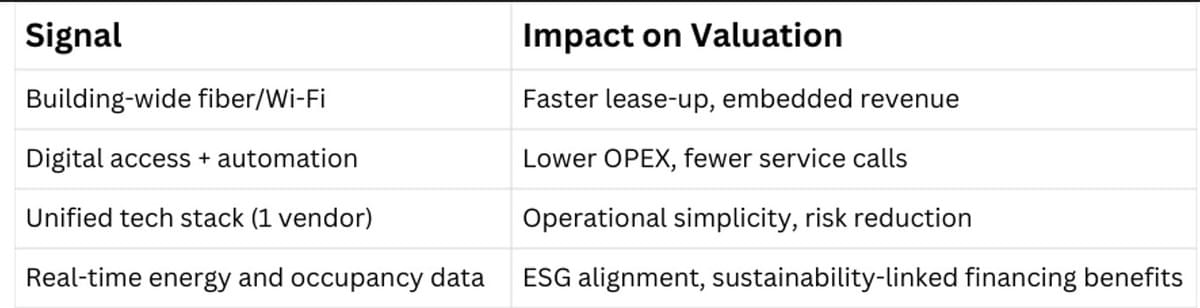

Infrastructure Signals to Look For

Case Snapshot: Underwriting the Hidden Value

An investor acquired a 300,000 sq ft asset in Phoenix. On paper: stabilized leases, decent rent roll.

But post-acquisition, OpticWise was engaged to layer in smart infrastructure:

- Energy spend dropped 19%

- Network uptime improved to 99.999%

- NOI rose by $312K in Year 1

The result? Cap rate moved from 6.1% to 5.3% on revaluation, unlocking a $3.2M equity gain.

What This Means For You

Every CRE asset is either:

- Infrastructure-ready and positioned for premium

- Or digitally underdeveloped and carrying hidden risk

Your underwriting model should evolve accordingly.

Step 1:

Get your copy of Peak Property Performance—the essential guide to understanding how smart infrastructure turns operational control into investment value.

Step 2:

Schedule your infrastructure-level PPP Audit before you underwrite your next asset.

Discover where value is hiding—or where it’s quietly bleeding out.

If you're not underwriting digital infrastructure, you're underwriting blind.